Alcatel-Lucent, Ciena, Cisco, Coriant, ECI Telecom, Fujitsu, Huawei, Infinera, NEC, and ZTE.]]]

このスコアカードは、サービスプロバイダーからのフィードバック、市場シェアデータ、公表されている財務データなど、実際のデータや計数を使った基準によりベンダーを評価している。このアプローチを採用することにより主観的な順位付けが排除され、ベンダーを正確かつ公平に評価することができる。このレポートの結果は、次のような質問に答えることができる。総合トップのスコアを獲得したベンダーはどこか? 各評価基準(市場シェア、研究開発投資、サービス・サポートなど)でトップとなったベンダーはどこか? それぞれのベンダーの強み、弱みは何か?

アナリストノート

「当社では、サービスプロバイダーがベンダーの強みと弱みを知ることができるよう、光事業を行っている大手企業を客観的に評価したいと考えていました。他社アナリストによるランキング手法とは異なり、当社のスコアカードは完全に定量的なアプローチを採用しているため主観性が排除されているほか、サービスプロバイダーおよび市場の意見を最も的確に反映しています」と、Infonetics Researchで光事業を担当している主席アナリストAndrew Schmitt氏は述べている。

このスコアカードは、サービスプロバイダーからのフィードバック、市場シェアデータ、公表されている財務データなど、実際のデータや計数を使った基準によりベンダーを評価している。このアプローチを採用することにより主観的な順位付けが排除され、ベンダーを正確かつ公平に評価することができる。このレポートの結果は、次のような質問に答えることができる。総合トップのスコアを獲得したベンダーはどこか? 各評価基準(市場シェア、研究開発投資、サービス・サポートなど)でトップとなったベンダーはどこか? それぞれのベンダーの強み、弱みは何か?

アナリストノート

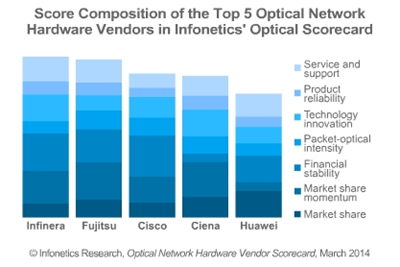

「当社では、サービスプロバイダーがベンダーの強みと弱みを知ることができるよう、光事業を行っている大手企業を客観的に評価したいと考えていました。他社アナリストによるランキング手法とは異なり、当社のスコアカードは完全に定量的なアプローチを採用しているため主観性が排除されているほか、サービスプロバイダーおよび市場の意見を最も的確に反映しています」と、Infonetics Researchで光事業を担当している主席アナリストAndrew Schmitt氏は述べている。Schmitt氏は続けて、「今回の結果を見ると、ベンダーの違いをもたらしているものは財務安定性と市場シェアの変化です。ここには、一部のベンダーが光伝送ネットワーク(OTN)やコヒーレントネットワークから利益を得ている結果が表れています。サービスプロバイダーからのフィードバックも重要な差別化要因で、この影響が大きかったのがCiena, Fujitsu, Infineraです」と述べている。 光ネットワークベンダースコアカードのハイライト

- Infineraは技術イノベーション、信頼性、サービス・サポートの評価が非常に高く、光伝送機器の全体スコアで最高点をマークした。

- Fujitsuは全体的にスコアが高かったほか、2013年の堅調な売上増、北米最大手サービスプロバイダーへの光パケット販売があったもののInfineraにわずかに及ばなかった。

- Ciscoは全ての評価基準で一貫して高い評価を獲得して第3位のポジションを確保した。

- Cienaは光ネットワーク業界ではリーダー的企業と見られることが多いが、Infoneticsの 光ベンダースコアカードでは4位であった。市場シェアや成長面では高いスコアを獲得したものの、財務安定性が低いことで高スコアが相殺された。

- 世界最大の光ハードウェアサプライヤーであるHuaweiは5位に浮上した。市場シェアでは完璧なスコアを獲得したが、市場シェア増加のスコアで押し下げられた。

Infinera, Fujitsu, Cisco, Ciena, and Huawei top Infonetics' new optical networking vendor scorecard Boston, MASSACHUSETTS, March 26, 2014-Market research firm Infonetics Research released excerpts from its new Optical Network Hardware Vendor Scorecard, which profiles, analyzes, and ranks the 10 largest global vendors of optical transport equipment: Alcatel-Lucent, Ciena, Cisco, Coriant, ECI Telecom, Fujitsu, Huawei, Infinera, NEC, and ZTE. The scorecard evaluates vendors entirely on criteria using actual data and metrics, such as direct feedback from service providers, market share data, and publicly available financial data. This approach eliminates subjective scoring and ensures vendors are assessed accurately and fairly. The report answers such questions as: Who is the top scoring vendor overall? Who are the top vendors by criteria (market share, R&D investment, service and support, etc.)? What are each vendor's strengths and weaknesses? ANALYST NOTE "We wanted to create an objective measurement of the largest companies in the optical area that allows service providers to see the relative strengths and weaknesses of vendors. Unlike other analyst ranking approaches, our scorecard takes an entirely quantitative approach that removes subjectivity and best reflects the opinion of service providers and the market," notes Andrew Schmitt, principal analyst for optical at Infonetics Research.

Schmitt continues: "Looking at the results, what really sets the vendors apart is financial stability and changes in market share as a result of some vendors capitalizing on the shift to optical transport networking (OTN) and coherent networking. Service provider feedback was also a key differentiator, particularly positive for Ciena, Fujitsu, and Infinera." OPTICAL NETWORK VENDOR SCORECARD HIGHLIGHTS

- With very high ratings for technology innovation, reliability, and service and support, Infinera received the highest overall score for optical transport equipment

- Fujitsu finished just a hair behind Infinera thanks to solid scores across the board and its strong 2013 revenue growth and packet-optical sales to tier-1 North American service providers

- Cisco secured 3rd place with consistent rankings across all criteria

- Viewed by most as the leader in the optical networking world, Ciena ranked 4th in Infonetics' optical vendor scorecard, as its relatively high scores in categories like market share and momentum were offset by a low financial stability rating

- The largest supplier of optical hardware worldwide, Huawei, rounds out the top 5, chalking up a perfect score for market share, but limited by a poor market share momentum score